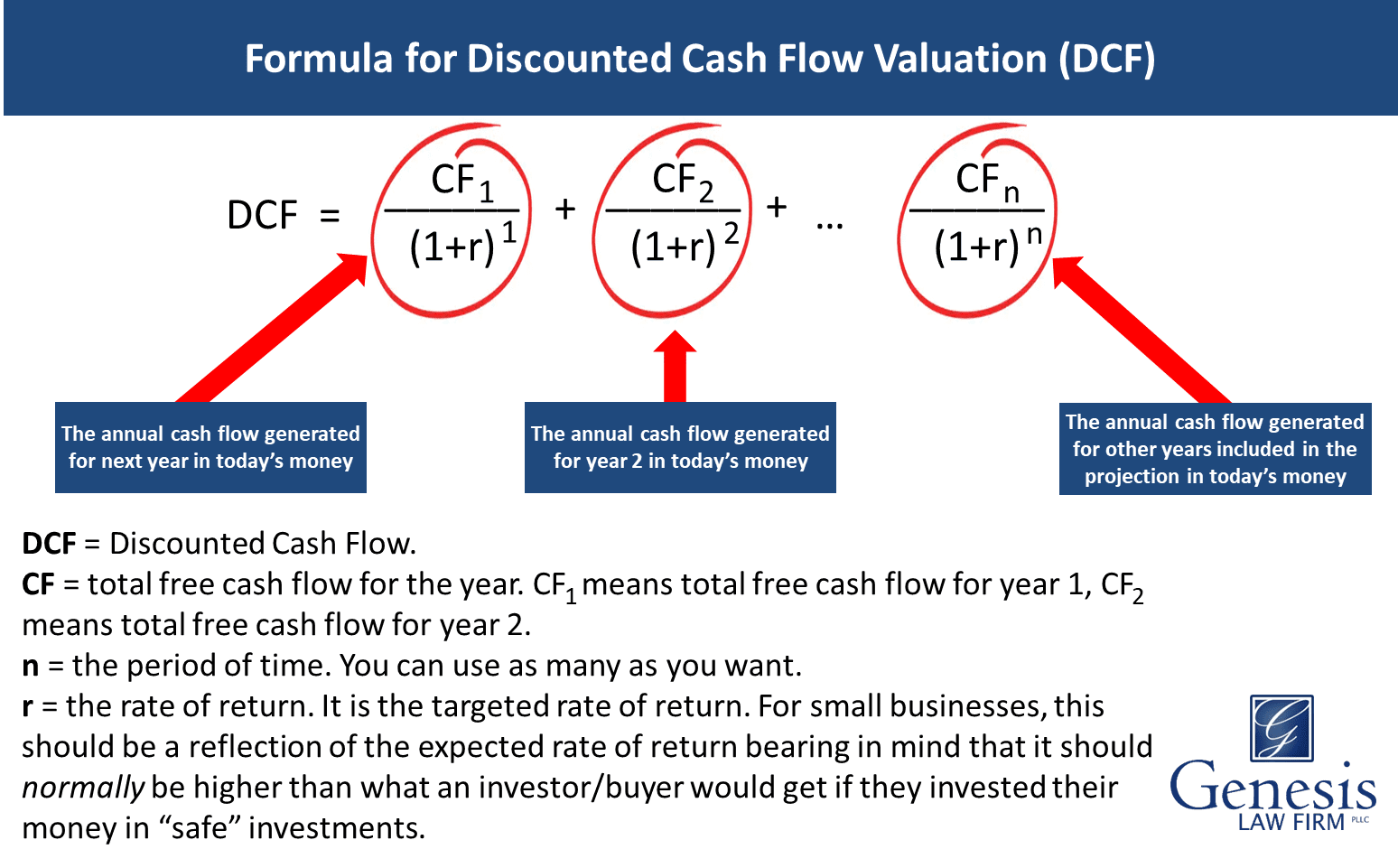

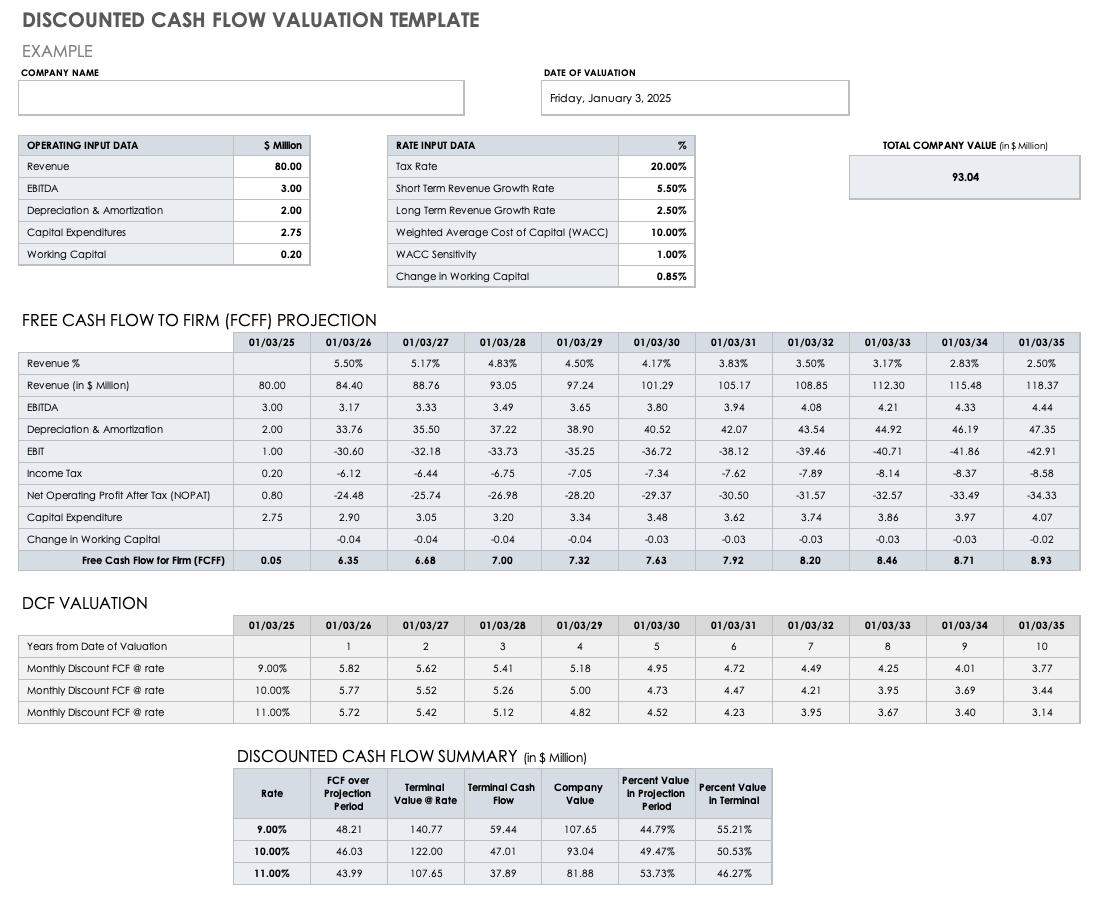

Now that we have understood the purpose of valuations, we move forward and introduce you to the most famous (or infamous) Discounted Cash Flow approach. This note discusses the Discounted Cash Flow (DCF) technique for valuing a business. The suitability of each technique is dependent on the purpose of the valuation and the information available. Other industry-specific techniques (eg takeover premium, leveraged buy-out models, break-ups, sum-of-the-parts (SOTP) valuations, liquidation values, and real options techniques) are also applied.

Comparable companies analysis (compcos): shows where a company should be trading if it were fairly valued by the market.There are primarily three methods of valuations. Asset transfers with a group (tax or restructuring).Contribution to joint venture or merger.Valuations can also be important for the purposes of establishing fee levels in engagement letters. It is extremely important therefore to keep in mind the purpose for which the valuation is intended. The valuation exercises that we undertake are generally from the view of what a business might cost to acquire or what price it might attract upon disposal.

It is a set of arguments supporting a view on value and we therefore usually express it as a range Purpose of Valuation The value will also be dictated by the level of ownership required:Ī valuation is not a scientific exercise and is dependent on the quality of information available. Different categories of buyers, strategic/corporate buyers versus financial buyers for example, maybe prepared to pay different prices. Irrespective of what any theoretical valuation indicates, in practice business or an asset is only worth what a purchaser will pay for it. In theory, the fair value of an asset is determined by the meeting of a willing, but not anxious, buyer and a willing, but not anxious, the seller.

0 kommentar(er)

0 kommentar(er)